AI Chip Comparison Calculator

Compare AI Chips for Your Use Case

This calculator helps you determine whether Indian-designed or global AI chips are better suited for your project based on your requirements.

Recommended Solution

Key Differences

India doesn’t just make smartphones and textiles anymore. It’s quietly building the brains behind the next wave of artificial intelligence - and that means AI chips.

If you’ve heard that India only imports chips from Taiwan, the U.S., or South Korea, you’re missing a major shift. Over the last three years, a handful of Indian startups and research labs have started designing and testing their own AI chips. These aren’t just prototypes. Some are already running in real-world systems - from rural health clinics to smart factories in Tamil Nadu.

Why India Needs Its Own AI Chips

Most AI systems today rely on chips made by NVIDIA, AMD, or Intel. But those chips are expensive, hard to get during global shortages, and often built for Western data centers - not for India’s unique needs.

Think about it: an AI model trained to recognize crop diseases in Hindi-speaking villages needs to run on low power, handle noisy audio, and work offline. A $5,000 NVIDIA GPU won’t cut it. That’s where Indian-designed chips come in. They’re built to be cheaper, smaller, and smarter for local conditions.

The government’s Semiconductor Mission, launched in 2021 with $10 billion in incentives, pushed this forward. By 2025, over 15 Indian companies were actively designing AI chips. A dozen of them have working prototypes. Three have started small-scale production.

NeuroSparq: The First Indian AI Chip to Ship in Volume

Based in Bengaluru, NeuroSparq launched its first chip, the NS-100, in early 2024. It’s a low-power inference chip designed for edge devices - think smart cameras, wearable health monitors, or agricultural sensors.

The NS-100 uses only 2 watts of power, compared to 15-50 watts for typical cloud-based AI chips. It runs custom neural networks trained on Indian languages and local image datasets. Hospitals in Uttar Pradesh are using it to detect tuberculosis from chest X-rays without needing internet access.

NeuroSparq partnered with Tata Electronics to manufacture the chip in a facility in Gujarat. By mid-2025, over 80,000 units had been shipped. That’s the first time an Indian-designed AI chip reached five-figure production numbers.

AIQ Labs: Building Chips for Smart Cities

AIQ Labs, founded by ex-Intel engineers from Hyderabad, created the Q-Edge chip. It’s built to handle real-time video analytics from traffic cameras and public surveillance systems.

Unlike foreign chips that struggle with Indian traffic patterns - like auto-rickshaws weaving between trucks or cows crossing highways - the Q-Edge was trained on over 2 million hours of Indian street footage. It can identify vehicle types, count pedestrians, and detect accidents with 94% accuracy, even in monsoon fog.

The chip is now used in pilot smart city projects in Pune, Jaipur, and Bhopal. It’s also being tested by the Delhi Metro to monitor crowd density in real time.

Verdan Tech: AI Chips for Rural Healthcare

Verdan Tech, a startup from Coimbatore, developed the MediCore-1 - a chip that runs AI models for diagnosing skin diseases, diabetic retinopathy, and pneumonia from basic medical scans.

What makes it special? It doesn’t need a powerful computer. It runs on a $20 microcontroller with a battery that lasts 48 hours. Community health workers in Jharkhand and Odisha carry these devices on motorbikes to remote villages.

Verdan partnered with the Indian Council of Medical Research (ICMR) to validate its models. In a 2024 trial across 12 districts, the chip matched doctor-level accuracy in detecting skin cancer in 89% of cases.

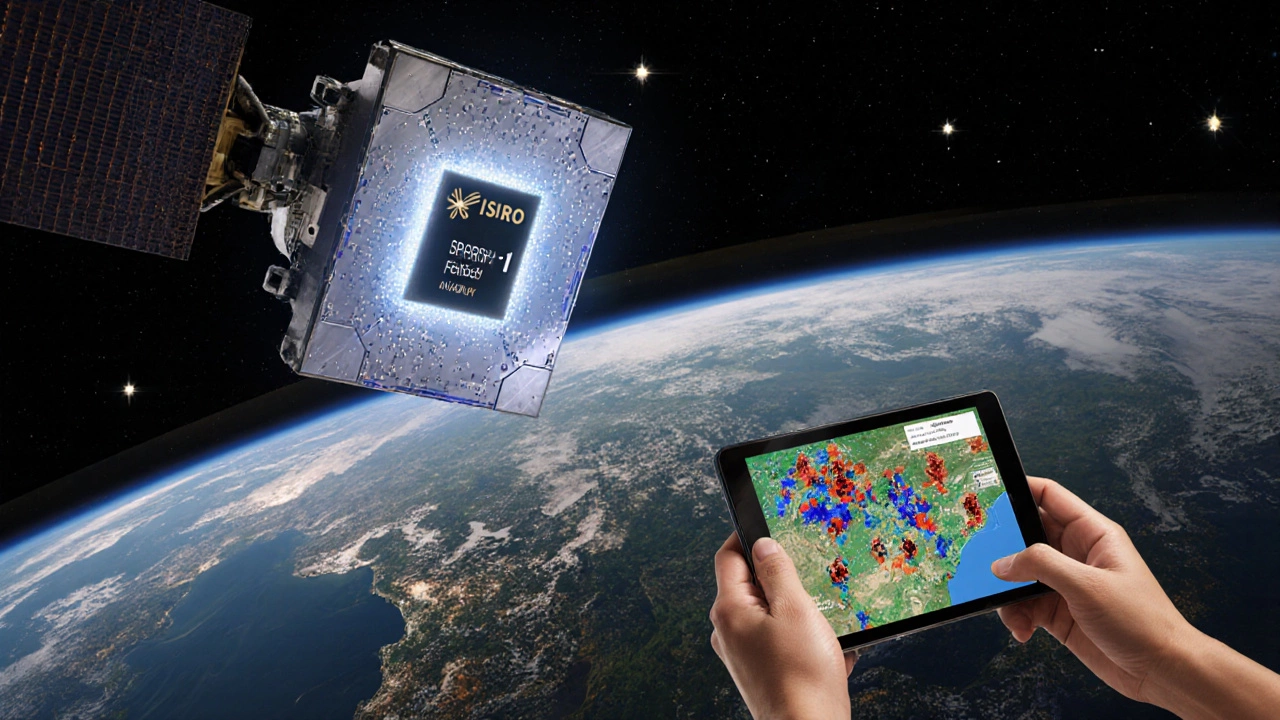

ISRO’s Space-Grade AI Chip: Not Just for Satellites

While private companies focus on consumer and industrial use, the Indian Space Research Organisation (ISRO) quietly developed its own AI chip - the SPARSH-1 - for use in satellites.

SPARSH-1 processes image data from earth observation satellites onboard, reducing the need to send raw data back to Earth. This saves bandwidth and speeds up disaster response. For example, during the 2024 floods in Kerala, SPARSH-1 identified flooded areas in real time, helping rescue teams prioritize areas.

ISRO has licensed the SPARSH-1 design to two Indian electronics firms for terrestrial use. One is now adapting it for mining safety systems in Chhattisgarh.

Other Key Players in the Indian AI Chip Scene

- Chitra AI (Pune): Focuses on AI chips for retail analytics - like tracking customer movement in crowded markets.

- Samudra Systems (Kolkata): Builds low-cost AI chips for fisheries and aquaculture, monitoring water quality and fish behavior.

- Yogitech (Chennai): Designs chips for industrial IoT - predicting machine failures in textile mills and small factories.

- MITRA AI (Delhi): A government-backed lab developing open-source AI chip architectures for public universities and startups.

What’s Missing? Manufacturing Capacity

Here’s the catch: India can design AI chips - but it still can’t mass-produce them at scale.

Most Indian startups send their chip designs to Taiwan or Singapore for fabrication. Only one facility in India, a pilot line in Bengaluru run by the Centre for Development of Advanced Computing (C-DAC), can produce chips in small batches (under 10,000 per month).

The government is building two new semiconductor fabs - one in Gujarat and one in Assam - set to go live in 2026. Until then, Indian AI chip companies are stuck in a middle ground: great design, limited production.

How These Chips Compare to Global Ones

| Feature | Indian AI Chips (e.g., NS-100, Q-Edge) | Global AI Chips (e.g., NVIDIA H100) |

|---|---|---|

| Power Consumption | 1-5 watts | 300-700 watts |

| Cost per Unit | $5-$15 | $10,000+ |

| Training Data Origin | Indian languages, local environments | Primarily Western datasets |

| Latency (Offline Use) | Under 100ms | Requires cloud connection |

| Production Location | Designed in India, made overseas | Designed and made in U.S., Taiwan, South Korea |

Indian chips aren’t trying to beat NVIDIA in raw power. They’re solving a different problem: making AI accessible, affordable, and relevant for India’s scale and complexity.

What’s Next for AI Chips in India?

The next two years will be critical. If the two new semiconductor fabs open on time, India could produce 500,000 AI chips annually by 2027. That’s enough to equip every rural health center, smart traffic light, and small factory in the country.

Startups are also starting to collaborate. NeuroSparq and Verdan Tech recently shared a common open-source AI model format called IndAI-1, so their chips can run each other’s software. That’s a big step toward building an ecosystem, not just isolated products.

India’s goal isn’t to become the next Taiwan. It’s to become the first country to build AI hardware that works for its own people - not just for Silicon Valley.

Are Indian AI chips better than imported ones?

They’re not better in raw performance - but they’re better for India. Indian chips use less power, cost a fraction of the price, and are trained on local data like Hindi speech or rural traffic patterns. If you’re running AI in a village clinic or a small factory, they’re the only practical choice.

Can I buy an Indian AI chip for my startup?

Yes - but only if you’re building a product that fits their use cases. NeuroSparq and Verdan Tech sell their chips in small batches to developers and startups. You’ll need to contact them directly. They don’t sell on Amazon or Alibaba. Expect to pay $10-$20 per chip, with bulk discounts for orders over 1,000 units.

Why aren’t Indian companies making chips locally yet?

Building a chip factory costs over $5 billion. India only has one small pilot facility. Two new fabs are under construction and should be ready by 2026. Until then, startups send designs overseas. That’s changing fast - but it’s still a bottleneck.

Do Indian AI chips work with TensorFlow or PyTorch?

Most do - but with a twist. They use custom compilers to convert models from TensorFlow or PyTorch into formats their chips can run. NeuroSparq and MITRA AI provide free tools to help developers do this. You don’t need to rewrite your code - just use their converter.

Is India going to dominate the global AI chip market?

Not in the way Taiwan or the U.S. do. India’s goal isn’t to sell chips to Apple or Google. It’s to build chips that solve Indian problems - and then export those solutions. Think of it as "AI for the Global South," not "AI for the world." That’s a different kind of leadership.

Final Thoughts

India isn’t just catching up in AI - it’s redefining what AI hardware can be. The chips made here aren’t flashy. They don’t have billion-dollar valuations. But they’re the first AI chips built for a country with 1.4 billion people, thousands of languages, and infrastructure that doesn’t always work.

That’s not just innovation. It’s necessity.