Generic Drug Price Comparison Calculator

How much do generic drugs cost?

Indian pharma companies make generic drugs at a fraction of the cost of Western brands. See how much you could save by comparing these prices.

Estimated Savings

$0.00 in savings per unit

Based on Indian manufacturing costs (0.01-0.10 USD per tablet) and U.S. retail pricing

Indian pharma companies like Sun Pharma and Cipla achieve these cost savings through:

- Low-cost manufacturing in India

- Efficient production processes

- Focus on volume over marketing

- Regulatory compliance with FDA standards

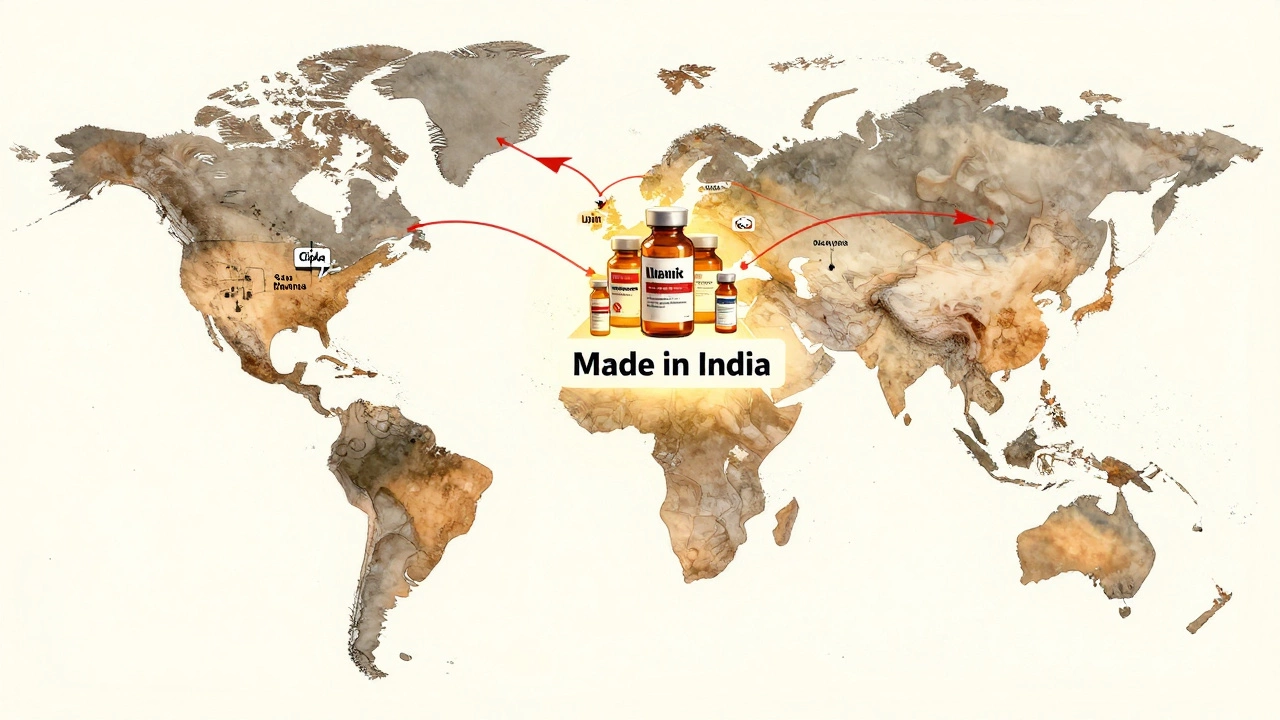

India makes one in every four pills you take around the world. But who owns the biggest pieces of that pie? When people ask who the billionaire pharma in India is, they’re not just looking for a name-they want to know who built empires from generic medicine, how they did it, and why their companies now ship drugs to every corner of the globe.

What makes a billionaire in India’s pharma industry?

It’s not just about having a big factory or a popular brand. The real billionaires in India’s pharmaceutical sector built companies that turned low-cost manufacturing into global powerhouses. They didn’t rely on fancy patents or blockbuster drugs. Instead, they cracked the code on making high-quality generic medicines cheaper than anyone else-and then sold them everywhere.

These are people who started with small labs, fought regulatory hurdles, and outmaneuvered Western giants by focusing on one thing: volume, efficiency, and trust. Their wealth comes from controlling supply chains, owning manufacturing plants in India and abroad, and having FDA-approved facilities that export to the U.S., Europe, and Africa.

Unlike tech billionaires who ride hype cycles, pharma billionaires in India built their fortunes slowly-over decades-by selling medicine that saves lives. And that’s what makes their success different.

Dr. Dilip Shanghvi: The quiet giant behind Sun Pharma

If you’re asking who the billionaire pharma in India is, the answer starts with Dr. Dilip Shanghvi. He’s the founder and chairman of Sun Pharmaceutical Industries, the largest pharma company in India by market value and the fifth-largest generic drug maker in the world.

Shanghvi started Sun Pharma in 1983 with just ₹10,000 and a small lab in Mumbai. He didn’t go to Harvard or Stanford. He studied pharmacy at Mumbai University and worked in his uncle’s pharma trading business. He saw how expensive branded drugs were and realized there was a gap: high-quality generics, sold at a fraction of the price.

By the early 2000s, Sun Pharma was exporting to the U.S. FDA had approved their facilities. They didn’t spend millions on ads. They focused on manufacturing excellence. Today, Sun Pharma has over 100 manufacturing sites across India, the U.S., Israel, and Brazil. Their products reach 100+ countries.

As of 2025, Shanghvi’s net worth is estimated at $22 billion. He owns over 50% of Sun Pharma. He doesn’t give interviews often. He doesn’t appear on Forbes lists to promote himself. But his company makes more than $7 billion in annual revenue-and that’s all from pills, capsules, and injections.

Other top billionaire pharma founders in India

Shanghvi isn’t alone. India has a handful of pharma billionaires who built companies worth billions. Here are the others:

- Navin Gupta - Founder of Lupin Limited. Started in 1968 with a single product. Now Lupin is a $5 billion company with a strong presence in the U.S. and Japan. Gupta’s net worth is around $4.5 billion.

- Y.K. Hamied - Son of Cipla’s founder. He turned Cipla into a global name by selling AIDS drugs at 1/100th the price of Western brands in the early 2000s. Cipla’s market cap is over $10 billion. Hamied’s family holds a controlling stake. His personal wealth is estimated at $3.8 billion.

- Divyank Turakhia - Founder of Zydus Cadila. He took over the family business in the 1990s and expanded aggressively into oncology and vaccines. Zydus now has 25 manufacturing units. Turakhia’s net worth is around $3.2 billion.

- Dr. B. V. S. Prasad - Co-founder of Dr. Reddy’s Laboratories. He helped build the company into a global player in complex generics and APIs. Dr. Reddy’s has FDA-approved plants in India and Russia. Prasad’s stake is worth over $2.5 billion.

These five names control more than 60% of India’s generic drug exports. Together, their companies employ over 200,000 people and generate more than $30 billion in annual revenue.

How they beat Big Pharma at its own game

How did Indian pharma billionaires beat companies like Pfizer and Merck? It wasn’t luck. It was strategy.

First, they focused on reverse engineering. When a drug’s patent expired, they studied the formula, found cheaper ways to make it, and got approval to sell it. They didn’t wait for permission-they worked with regulators to prove their versions were just as safe.

Second, they built low-cost manufacturing. Labor, land, and raw materials are cheaper in India. They used that advantage to make pills for pennies. A single tablet of metformin, for example, costs $0.01 to make in India. In the U.S., it’s sold for $1.50.

Third, they targeted markets others ignored. While Western companies chased rich countries, Indian pharma giants sold to Africa, Southeast Asia, and Latin America. They built distribution networks in places where hospitals had no refrigeration, and pharmacies were miles away.

And when the U.S. FDA cracked down on quality in the 2010s, these companies didn’t panic. They invested millions in upgrading labs, hiring FDA-trained staff, and automating production. Sun Pharma alone spent over $1 billion on compliance over 10 years.

The hidden cost: What’s not talked about

It’s easy to celebrate these billionaires. But their success came with trade-offs.

Many of their factories operate in areas with weak environmental oversight. Waste from drug manufacturing has polluted rivers in Telangana and Andhra Pradesh. Protests have happened. Some plants have been shut down.

Also, while these companies make billions, many of their workers earn less than $300 a month. The CEOs live in luxury homes in Mumbai and London. But the factory workers who pack the pills often don’t have health insurance.

And then there’s the issue of drug access. Even though these companies make cheap medicines, many poor Indians still can’t afford them. A month’s supply of insulin might cost ₹500. That’s a week’s wage for a daily wage worker.

So yes, they’re billionaires. But their story isn’t just about wealth-it’s about power, responsibility, and the gap between profit and public health.

Why this matters beyond India

When you take a generic antibiotic, a blood pressure pill, or a diabetes drug, there’s a 70% chance it came from India. That’s not a coincidence. It’s the result of these billionaires building systems that scale.

The U.S. depends on India for 80% of its active pharmaceutical ingredients (APIs). The EU gets over 40% of its generic drugs from Indian manufacturers. If any of these companies face a supply disruption, hospitals in America and Europe feel it.

That’s why governments in the U.S., UK, and EU are now trying to bring drug production back home. But it’s not easy. Making a single tablet with the same quality as Sun Pharma’s costs three times as much in Ohio as it does in Gujarat.

These billionaires didn’t just make money. They changed how the world gets medicine.

Who’s next? The new generation

The old guard is still in charge. But the next wave is coming.

Younger entrepreneurs are focusing on biosimilars, mRNA vaccines, and specialty drugs. Companies like Biocon, led by Kiran Mazumdar-Shaw, are moving beyond generics into high-tech biologics. Biocon’s market cap is now over $8 billion.

Startups are using AI to design new drug formulations faster. Others are partnering with African governments to build local manufacturing. The goal isn’t just to sell pills-it’s to own the entire supply chain, from raw materials to final delivery.

The next billionaire pharma figure in India might not come from Mumbai or Hyderabad. They might come from a small town in Odisha or Rajasthan, running a single plant that exports to 20 countries.

The rules haven’t changed: make it cheap, make it safe, make it global. But the tools? They’re getting smarter.

Who is the richest pharma person in India?

Dr. Dilip Shanghvi, founder of Sun Pharmaceutical Industries, is the richest pharma entrepreneur in India. As of 2025, his net worth is estimated at $22 billion. He owns over half of Sun Pharma, which is the largest generic drug maker in India and one of the top five globally.

How did Indian pharma billionaires get so rich?

They built companies that made high-quality generic drugs at a fraction of the cost of Western brands. By reverse-engineering expired patents, using low-cost labor and materials in India, and getting FDA approval for their factories, they captured global markets. Sun Pharma, Cipla, and Dr. Reddy’s now supply over 40% of the world’s generic medicines.

Is Sun Pharma the biggest pharma company in India?

Yes. Sun Pharmaceutical Industries is the largest pharmaceutical company in India by market capitalization and revenue. It has over 100 manufacturing facilities worldwide and exports to more than 100 countries. Its annual revenue exceeds $7 billion.

Do Indian pharma companies make drugs for the U.S.?

Yes. Over 80% of the active ingredients in U.S. generic drugs come from India. Companies like Sun Pharma, Lupin, and Dr. Reddy’s supply pills for major American pharmacies like CVS and Walmart. Their factories are FDA-inspected and approved.

Why are Indian pharma drugs so cheap?

They use low-cost labor, affordable raw materials, and efficient manufacturing processes. Indian companies don’t spend money on expensive marketing or patent litigation. They focus on volume and scale. For example, a single tablet of metformin costs just $0.01 to produce in India but sells for over $1.50 in the U.S.