US Steel Producer Comparison Calculator

Compare production volumes between the top US steel producers. See how Nucor's output dwarfs competitors and verify the claim that it produces more than the next two companies combined.

Nucor Corporation

Largest US steel producer by volume

US Steel

Specialty steel leader

ArcelorMittal USA

Global steel leader in US market

Production Comparison

The US steel industry isn't just about factories and smokestacks-it's about who delivers the raw material that builds your cars, bridges, skyscrapers, and appliances. If you're asking who the biggest steel supplier in the US is, the answer isn't just about volume. It's about production capacity, innovation, and how well a company adapts to shifting markets. And right now, the leader isn't the name you might expect from history books.

Who Actually Leads the US Steel Market?

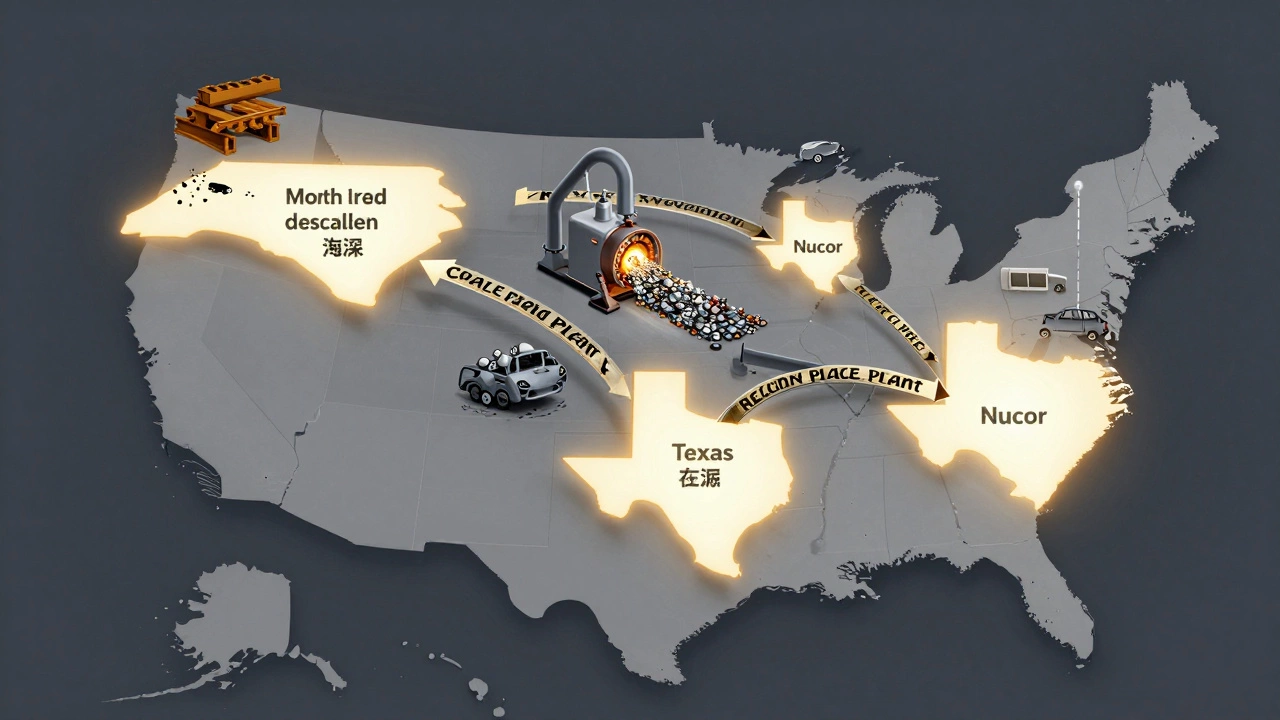

Nucor Corporation is the largest steel producer in the United States by volume. Headquartered in Charlotte, North Carolina, Nucor doesn’t operate giant blast furnaces like the old-school mills. Instead, it uses electric arc furnaces (EAFs) that melt scrap steel using electricity. This method is cleaner, more flexible, and faster to ramp up or down based on demand. In 2025, Nucor produced over 23 million tons of steel across 100+ facilities nationwide. That’s more than the next two competitors combined.

Why does this matter? Because Nucor’s model lets it respond to market swings better than anyone else. When construction slowed in 2023, Nucor shifted output to automotive and appliance steel. When infrastructure bills kicked in, they opened new sheet steel plants in Texas and Ohio. Their agility comes from decentralized operations-each plant runs like its own small business with profit-sharing for employees. That’s not just smart management; it’s a competitive edge.

How Nucor Compares to Other Major Players

It’s easy to think of US Steel or ArcelorMittal as the giants, but the landscape changed decades ago. Here’s how the top three stack up in 2025:

| Company | Annual Production (Million Tons) | Primary Technology | Key Markets |

|---|---|---|---|

| Nucor | 23.1 | Electric Arc Furnace (EAF) | Construction, Automotive, Appliances |

| US Steel | 11.8 | Blast Furnace + EAF | Energy, Heavy Machinery, Tubing |

| ArcelorMittal USA | 9.5 | Blast Furnace | Automotive, Construction |

Nucor’s output dwarfs the others, but it’s not just about numbers. US Steel still dominates in specialty products like pipeline steel and heavy plate for oil rigs. ArcelorMittal holds strong in automotive sheet steel, supplying Tesla, Ford, and GM. But none of them match Nucor’s scale, geographic spread, or ability to pivot.

Why Electric Arc Furnaces Changed Everything

Before Nucor, steel was made in massive, capital-intensive blast furnaces that burned coal and iron ore. These plants needed steady demand to stay profitable. One slowdown could mean layoffs or shutdowns.

Nucor flipped the script. By using scrap metal and electricity, they cut energy use by 70% compared to traditional methods. They also cut emissions. Their EAFs can start up in under an hour. A blast furnace? It takes weeks to heat up and cool down. That means Nucor can ramp production during housing booms and scale back during recessions without massive losses.

They also own their supply chain. Nucor runs recycling centers that collect scrap from demolished buildings, old cars, and appliances. This isn’t just environmentally smart-it’s economically smart. Scrap prices are lower and more stable than iron ore, which is subject to global market swings. In 2024, Nucor sourced over 80% of its raw material from domestic scrap.

What About Imports? Are Foreign Suppliers a Threat?

The US still imports about 15% of its steel needs, mostly from Canada, Mexico, and South Korea. But tariffs on steel imports have been in place since 2018, and they’re still active. The 25% tariff on foreign steel under Section 232 protects domestic producers from being undercut by cheaper, often state-subsidized foreign mills.

That doesn’t mean imports are gone. High-end automotive steel, specialty alloys for aerospace, and certain stainless steels still come from abroad. But for structural beams, rebar, sheet metal, and pipe-the backbone of American infrastructure-Nucor and its peers supply over 85% of demand.

Where Does the Steel Go?

It’s not just about who makes it-it’s about where it ends up. In 2025, Nucor’s steel went into:

- Over 40% into construction (bridges, warehouses, commercial buildings)

- 25% into automotive (body panels, chassis, structural parts)

- 18% into appliances (refrigerators, washing machines, HVAC systems)

- 12% into industrial machinery and pipelines

- 5% into defense and aerospace components

This diversification is key. When housing starts dropped in 2023, Nucor didn’t collapse-they leaned into auto and infrastructure projects funded by the Bipartisan Infrastructure Law. That’s why they’ve stayed profitable through multiple economic cycles.

What’s Next for the US Steel Industry?

The next big shift is green steel. Nucor is investing $1.2 billion in hydrogen-based direct reduced iron (DRI) technology at a new plant in Louisiana. This will cut carbon emissions by 90% compared to today’s EAFs. It’s not just about being green-it’s about staying competitive. The EU and China are already pushing carbon tariffs on steel exports. US producers need to match or beat those standards.

Other companies are catching up. US Steel is testing carbon capture tech at its Gary plant. ArcelorMittal is piloting hydrogen in Indiana. But Nucor’s scale and decentralized model give them a head start. They’re not waiting for federal mandates-they’re building the future themselves.

Final Answer: Nucor Is the Biggest Steel Supplier in the US

So, who is the biggest steel supplier in the US? Nucor. Not because they’re the oldest. Not because they have the biggest name. But because they built a system that’s more efficient, more responsive, and more adaptable than any other. They turned scrap into a strategic advantage. They turned local plants into profit centers. And they turned steelmaking into a lean, agile business.

If you’re looking for the company that supplies the most steel, shapes the industry’s future, and keeps American infrastructure strong-you’re looking at Nucor.

Is Nucor the only major steel producer in the US?

No, Nucor is the largest, but not the only one. US Steel and ArcelorMittal USA are major players, each with distinct strengths. US Steel focuses on heavy plate and pipeline steel, while ArcelorMittal dominates in automotive sheet. There are also smaller producers like Steel Dynamics and Commercial Metals Company that serve niche markets.

Why does Nucor use electric arc furnaces instead of blast furnaces?

Electric arc furnaces melt scrap steel using electricity, which is faster, cheaper, and cleaner than blast furnaces that rely on coal and iron ore. EAFs can start and stop quickly, making them ideal for fluctuating demand. They also use 60-70% less energy and produce far fewer emissions. Nucor’s entire business model is built around this efficiency.

How much of US steel comes from recycled material?

About 70% of US steel production comes from recycled scrap, mostly from old cars, appliances, and demolished buildings. Nucor uses over 80% scrap in its process. This makes the US one of the world’s most efficient steel recyclers. Steel is 100% recyclable without losing quality, which is why it’s the most recycled material on the planet.

Are US steel companies affected by global tariffs?

Yes. Since 2018, the US has imposed a 25% tariff on most imported steel under Section 232. This protects domestic producers from cheaper foreign steel, especially from countries with state-backed mills. While imports still make up about 15% of US supply, the tariff has helped US producers maintain pricing power and invest in new technology.

What is green steel, and is the US producing it?

Green steel is made using hydrogen instead of coal to reduce iron ore, cutting carbon emissions by over 90%. Nucor is building one of the first commercial green steel plants in the US using hydrogen-based DRI technology. Other companies like US Steel and ArcelorMittal are testing similar systems. While it’s still early, green steel is becoming a necessity to meet future environmental regulations and global trade standards.