Textile City Comparison Tool

Compare India's Textile Hubs

Explore key metrics of India's major textile cities to understand their economic impact and industry dominance.

Comparison Results

Select a city to compare with Surat

* Surat leads India's textile industry with $10.2 billion in annual output and 420,000 workers employed

When people wonder which place wears the crown of the textile city of India, the answer points straight to the bustling coastal hub of Surat. This city isn’t just another dot on the map; it pulses with looms, dye houses, and a trade network that stretches across continents.

Key Takeaways

- Surat, located in Gujarat, dominates India’s synthetic and silk textile production.

- It contributes over $10billion annually to India’s textile exports.

- Powerloom clusters in Surat employ more than 400,000 workers.

- Compared to Ahmedabad, Coimbatore, and Tirupur, Surat leads in volume of synthetic fabric output.

- Government schemes like the Textile Cluster Development Programme boost Surat’s competitiveness.

Why Surat Earned the Title

Surat is a coastal city in Gujarat, India. Historically a port for cotton trade, the city pivoted to synthetic fibers in the 1970s when polyester demand exploded. Today, Surat’s textile market processes roughly 1.5million tons of fabric each year, split between silk, synthetic blends, and specialty yarns.

The surge began with the establishment of the first powerloom units in the Hiranandani Industrial Area. By the late 1990s, over 10,000 powerlooms were churning out fabrics for domestic brands and export orders. The city’s logistics advantage-proximity to the Surat Port and a well‑connected railway network-means a single container can reach Europe in under three weeks.

Surat’s Core Textile Segments

Three pillars keep Surat’s textile engine humming:

- Silk - The city produces premium mulberry silk, especially for bridal wear. Annual silk turnover tops $1.2billion.

- Synthetic Fabrics - Polyester, nylon, and blended fabrics dominate, accounting for roughly 60% of total output.

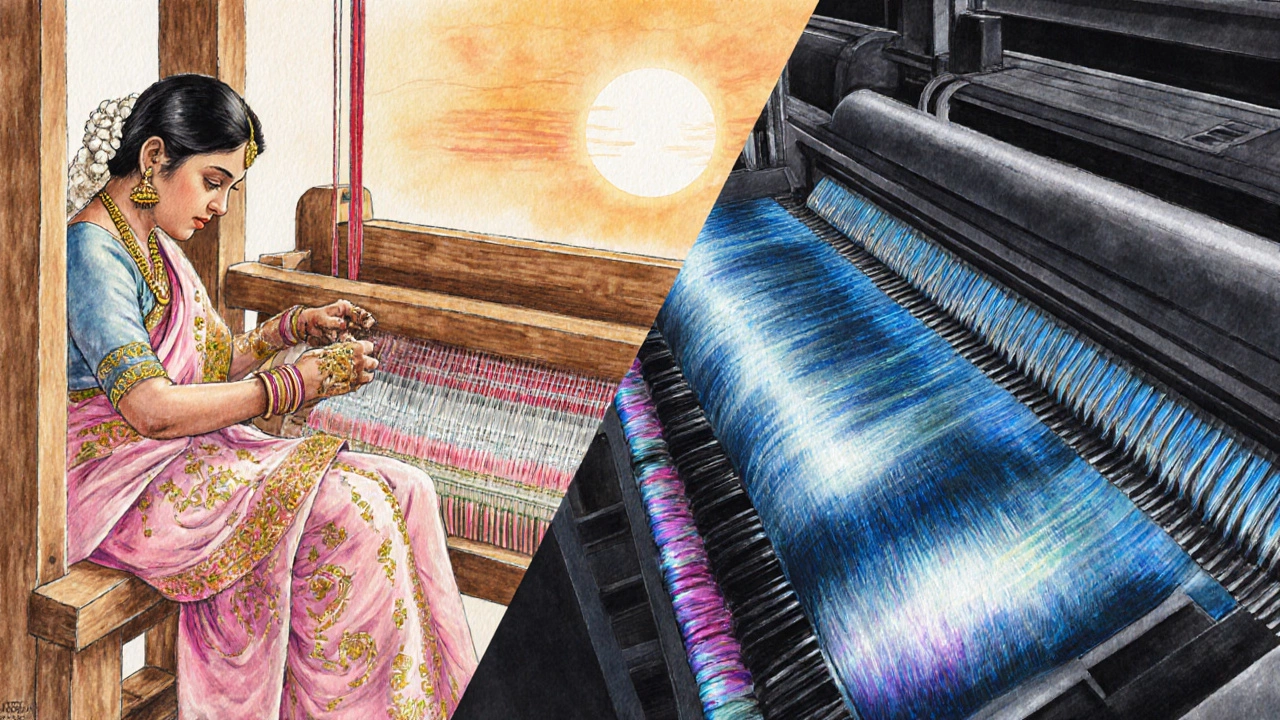

- Handloom & Powerloom - While handloom artisans preserve traditional motifs, powerloom clusters handle high‑speed production, employing the majority of the workforce.

Comparison with Other Indian Textile Hubs

| City | Primary Fabric Type | Annual Output (Million USD) | Employment (Thousands) | Export Share (%) |

|---|---|---|---|---|

| Surat | Synthetic & Silk | 10.2 | 420 | 23 |

| Ahmedabad | Cotton | 7.8 | 310 | 18 |

| Coimbatore | Textile Machinery & Cotton | 6.4 | 250 | 15 |

| Tirupur | Garments | 5.9 | 200 | 12 |

The table shows Surat leading in both monetary output and export proportion, largely thanks to its synthetic fabric dominance.

Economic Impact on Gujarat and India

Surat’s textile boom fuels Gujarat’s GDP, contributing roughly 4% of the state’s industrial output. The Textile Industry also supplies raw material to downstream sectors such as fashion design, home décor, and technical textiles.

Export figures illustrate the city’s global reach: in FY 2023‑24, Surat shipped over 1.1million meters of fabric to the United States, the United Kingdom, and the Middle East, earning an estimated $3.5billion in foreign exchange.

Challenges and Future Outlook

Despite its strength, Surat faces hurdles:

- Environmental regulations - Synthetic dyeing consumes large water volumes; stricter effluent standards demand cleaner technologies.

- Labor skill gaps - Automation is creeping in, reducing demand for low‑skill workers while increasing the need for technically trained operators.

- Global competition - Countries like Bangladesh and Vietnam offer lower production costs, pressuring Surat’s exporters to innovate.

Government initiatives, such as the Textile Cluster Development Programme, provide subsidies for modern machinery and eco‑friendly dyeing units. Industry leaders also invest in digital supply‑chain platforms, allowing real‑time order tracking and inventory optimization.

Looking ahead, experts forecast that Surat will maintain its top‑rank status if it embraces sustainable practices and upskilling. By 2030, the city aims to increase its export share to 30% of India’s total textile exports.

Next Steps for Stakeholders

Investors: Explore joint ventures with established powerloom owners; focus on green technology grants.

Job seekers: Upskill in textile engineering or digital design to meet the rising demand for skilled operators.

Policy makers: Continue financial incentives for water‑recycling plants and promote R&D in bio‑based fibers.

Frequently Asked Questions

Why is Surat called the textile city of India?

Surat earns the nickname because it dominates India’s synthetic and silk fabric production, accounts for over $10billion in annual textile revenue, and leads the country’s textile export market.

What are the main types of fabrics produced in Surat?

The city specializes in polyester and nylon synthetic blends, premium mulberry silk, and a growing segment of eco‑friendly blended fabrics.

How many people work in Surat’s textile sector?

Approximately 420,000 workers are employed across powerloom, handloom, and ancillary services.

Which Indian cities compete with Surat in textiles?

Ahmedabad (cotton focus), Coimbatore (cotton and machinery), and Tirupur (garments) are the primary rivals, each excelling in different niche segments.

What government schemes support Surat’s textile industry?

Key programs include the Textile Cluster Development Programme, Pradhan Mantri MUDRA Yojana for micro‑enterprises, and subsidies for effluent treatment plants.