Top Indian Textile Companies - 2024-25

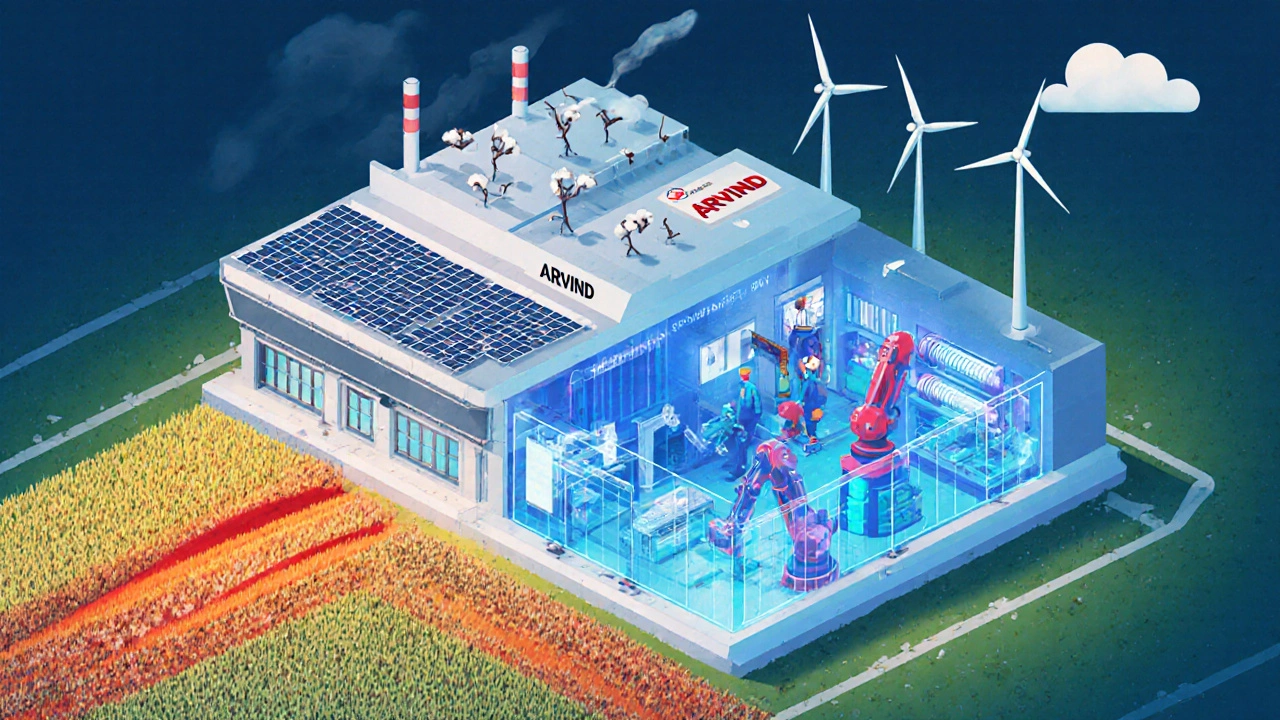

Arvind Limited

Revenue: ₹12,300 Crore

Yarn Capacity: 1.2 Million Tonnes

Fabric Output: 1 Billion Metres

Key Strength: Integrated Value Chain

Vardhman Textiles Ltd

Revenue: ₹8,300 Crore

Yarn Capacity: 950,000 Tonnes

Fabric Output: 0.8 Billion Metres

Key Strength: Cotton-Yarn Portfolio

Raymond Ltd

Revenue: ₹7,500 Crore

Yarn Capacity: 500,000 Tonnes

Fabric Output: 0.6 Billion Metres

Key Strength: Premium Suited & Denim

Welspun India Ltd

Revenue: ₹6,900 Crore

Yarn Capacity: 400,000 Tonnes

Fabric Output: 0.9 Billion Metres

Key Strength: Home-Textiles & Export

Industry Insights

Market Share: Top 5 companies hold ~55% of the domestic market.

Employment: The sector employs over 45 million people.

GDP Contribution: ₹1.9 trillion in FY 2024.

Exports: ₹1.3 trillion in FY 2024.

Growth Drivers

- Export Demand

- Government Incentives

- Technical Textiles Shift

- Sustainability Focus

Quick Facts About Arvind Limited

- Outpaces rivals by over ₹3,000 crore in revenue

- Operates 13 fabric plants, 7 apparel units, and 5 technical-textile facilities

- Launched 100% recycled polyester line in 2023

- Over 30% of output goes to international markets

- Holds more than 250 patents in textile processing

When you hear "largest textile industry in India", the name that most experts point to today is Arvind Limited, a vertically integrated giant that spins, weaves, processes and markets cotton, polyester and blended fabrics across the globe.

Key Takeaways

- Arvind Limited is the biggest textile company in India by revenue (FY2024≈₹12,300crore).

- It leads in production capacity - over 1.2million tonnes of yarn and 1billion metres of fabric annually.

- The top five Indian textile manufacturers together hold roughly 55% of the domestic market.

- Growth is driven by export demand, government incentives and a shift toward technical textiles.

- Challenges include raw‑material price volatility, energy costs and competition from synthetic‑fiber producers.

Indian Textile Industry at a Glance

The Indian textile sector is the second‑largest employer after agriculture, providing jobs to more than 45million people. In FY2024 the industry contributed ₹1.9trillion to the national GDP and exported goods worth ₹1.3trillion, making it a key pillar of the “Make in India” agenda.

Key segments include cotton yarn & fabric, denim, garments, technical textiles, and home‑textiles. While cotton remains dominant (≈65% of total fibre consumption), synthetic fibres such as polyester are rapidly closing the gap thanks to cheaper production and higher performance.

Why Arvind Leads the Pack

Arvind Limited tops the rankings for several reasons:

- Revenue muscle: FY2024 reported a turnover of ₹12,300crore, outpacing the nearest rival by over ₹3,000crore.

- Integrated supply chain: The company controls everything from cotton ginning to garment manufacturing, reducing dependency on external suppliers.

- Capacity scale: It operates 13 fabric plants, 7 apparel units and 5 technical‑textile facilities, cumulatively producing 1.2million tonnes of yarn each year.

- Innovation focus: Arvind invests heavily in sustainable fabrics - it launched a 100% recycled polyester line in 2023 and holds more than 250 patents related to textile processing.

- Export footprint: Over 30% of its output goes to North America, Europe and the Middle East, making foreign‑exchange earnings a strong growth driver.

Top 5 Textile Manufacturers in India (2024‑25)

| Company | FY2024 Revenue (₹crore) | Annual Yarn Capacity (tonnes) | Fabric Output (billion metres) | Employees | Key Strength |

|---|---|---|---|---|---|

| Arvind Limited | 12,300 | 1,200,000 | 1.0 | 30,000 | Integrated value chain & sustainable fabrics |

| Vardhman Textiles Ltd | 8,300 | 950,000 | 0.8 | 22,000 | Strong cotton‑yarn portfolio |

| Raymond Ltd | 7,500 | 500,000 | 0.6 | 18,000 | Premium suiting & denim |

| Welspun India Ltd | 6,900 | 400,000 | 0.9 | 15,000 | Home‑textiles and large‑scale export |

| Grasim Industries Ltd | 6,200 | 350,000 | 0.5 | 12,000 | Viscose & blended fabrics |

Drivers Behind the Industry’s Growth

Several macro trends fuel the surge of these textile titans:

- Government support: The Amended Textile Policy 2025 offers a 15% subsidy on technology upgradation and a 10% interest rebate for green‑energy projects.

- Export push: Free Trade Agreements with the EU and US have cut tariffs, boosting demand for high‑quality Indian fabrics.

- Shift to technical textiles: Sectors like automotive, healthcare and defense now source engineered fabrics locally, opening higher‑margin opportunities.

- Sustainability pressure: Brands worldwide demand recycled or organic fibres; companies that invest early, like Arvind, gain a pricing premium.

Challenges Facing the Leaders

Even the biggest players grapple with common hurdles:

- Raw‑material volatility: Cotton prices can swing 30% year‑on‑year, affecting margins for yarn‑centric firms.

- Energy costs: Textile processing is energy‑intensive; fluctuating power tariffs erode profit unless firms adopt captive solar.

- Labor dynamics: While automation improves productivity, skilled workforce shortages in high‑tech segments remain.

- International competition: China’s Belt‑and‑Road initiatives are improving its quality perception, squeezing Indian export shares.

How to Keep Track of the Industry Leaders

If you’re an investor, supplier or a budding entrepreneur, here are three practical ways to stay updated:

- Subscribe to the quarterly earnings releases of the top five companies - they disclose capacity expansions, export orders and sustainability metrics.

- Follow the Ministry of Textiles’ monthly performance bulletin for policy changes, export‑promotion schemes and sector‑wide capacity data.

- Use industry platforms like **Textile Outlook International** or **India Brand Equity Foundation (IBEF)** for third‑party analysis and market‑share reports.

Frequently Asked Questions

Which company currently has the highest revenue in the Indian textile sector?

Arvind Limited leads with a FY2024 turnover of approximately ₹12,300crore, making it the highest‑earning textile firm in India.

What are the main products that make Arvind the market leader?

Arvind’s portfolio spans cotton yarn, denim, blended fabrics, technical textiles, and a growing line of recycled‑polyester garments. Its integrated model lets it control everything from raw cotton to finished apparel.

How much of India’s textile exports come from the top five manufacturers?

Collectively, the five biggest firms account for roughly 45‑50% of total textile export value, with Arvind alone shipping about 12% of the nation’s exported fabric volume.

What government initiatives are helping these companies grow?

The Amended Textile Policy 2025 offers subsidies for technology upgrades, tax rebates for using renewable energy, and a dedicated export incentive fund aimed at boosting high‑value textile trade.

Are there any emerging risks that could threaten the dominance of the top textile firms?

Rising cotton prices, stricter environmental regulations and intensifying competition from synthetic‑fiber producers in China and Southeast Asia are the main risk factors that could compress margins and erode market share.